Auto-Invest Like a Boss

Run Your Own AI Hedge Fund Team

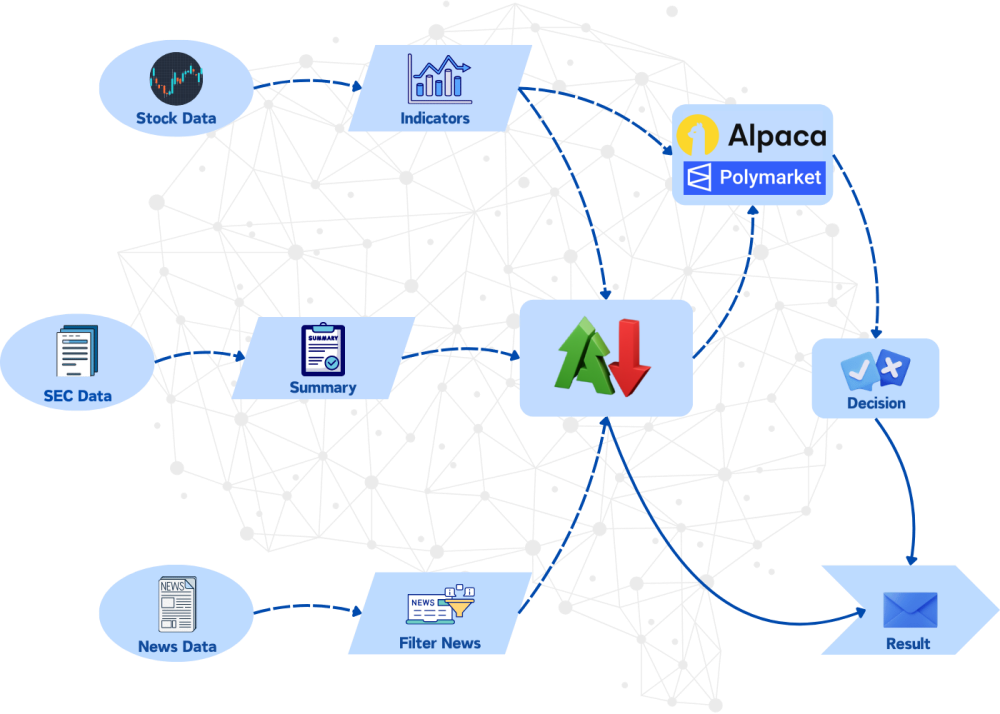

Deploy specialized AI agents with algorithmic trading strategies across stocks and prediction markets. Track sharp traders on Polymarket & Kalshi, analyze outcomes with LLM-powered research, and execute momentum, breakout, and scalping strategies with institutional-grade risk management.

Automation of Hedge Fund Level of Research

Our AI agents analyze candlestick patterns, moving averages, and technical indicators in real-time, providing institutional-grade market insights.

- Pattern Recognition

- Technical Indicators

- Sentiment Analysis

- Risk Assessment

Core Stock APIs

Real-time and historical OHLCV price data for any ticker

Technical Indicators

50+ technical indicators for pattern recognition and momentum signals

News & Sentiment

AI-powered sentiment analysis from news articles and media coverage

Insider Transactions

Track insider buying and selling activity for early signals

Fundamental Data

Financial statements, ratios, and company metrics for valuation

Economic Indicators

Macroeconomic data for market regime and sector rotation analysis

Polymarket & Kalshi Analysis

Research-based LLM analysis on prediction market outcomes with copy trading signals from top investors, senators, and traders

LLM Outcome Analysis

AI-powered analysis of market outcomes using news, sentiment, and historical data

85% accuracySharp Trader Tracking

Follow and copy trades from top-performing prediction market traders

Top 1% tradersReal-time Signals

Instant alerts when sharp money moves on high-conviction trades

5min updatesPortfolio Correlation

Analyze how prediction markets correlate with your stock positions

Multi-asset

| Rank | Trader | Overall PnL | Win Rate | Action |

|---|---|---|---|---|

1 | Warren Buffett legendValue Investing | $8.22M | 82.1% | |

2 | Theo whalePolitics | $5.85M | 68.4% | |

3 | Dan Crenshaw senateDefense & Energy | $4.22M | 74.5% | |

5 | Fredi9999 sharpEconomics | $3.22M | 72.1% | |

6 | Cathie Wood fund-managerDisruptive Tech | $2.95M | 69.3% | |

7 | SilverVVolf consistentSports | $2.85M | 65.8% | |

8 | Domer sharpTech | $2.16M | 71.2% |

LLM Outcome AnalysisLive

Our AI agents analyze prediction market data alongside news sentiment, social media trends, and historical patterns to identify high-probability outcomes and arbitrage opportunities.

Markets Analyzed

1,247

Avg. Edge Detected

+4.2%

Sharp Money Alerts

23 today

Stock Price Correlations with Event Prediction

Discover how prediction markets correlate with traditional securities across sectors. Our AI identifies non-obvious relationships, providing 45-60 day advance signals for strategic positioning.

Related Securities

Trading Strategy

Track elite forecasters who correctly predicted GPT-4 release timing. Their insights on GPT-5 timeline correlate with +/-5% moves in MSFT within 48 hours.

Related Securities

Trading Strategy

Geopolitical superforecasters predict Taiwan scenarios. Consensus moving from 15% → 25% preceded 12% TSM decline in backtests.

Related Securities

Trading Strategy

Elite forecasters with Apple product launch track records provide 2-4 week advance signals. When consensus reaches 60%+, IV underprices event impact by 15-20%.

XGBoost & Prophet TimeSeries ML Models

Our platform combines 5-10 prediction market signals to forecast individual stock movements. The system requires 3 validation criteria before generating high-conviction signals: elite forecaster consensus (top 2% show >65% agreement), cross-market confirmation (multiple related markets align), and traditional indicator confluence (technical analysis and fundamentals support prediction market signal). When all criteria meet thresholds, historical accuracy exceeds 70% over 3-6 month horizons.

Correlation Pairs Tracked

2,400+

Average Lead Time

45-60 days

Forecast Accuracy

60-70%

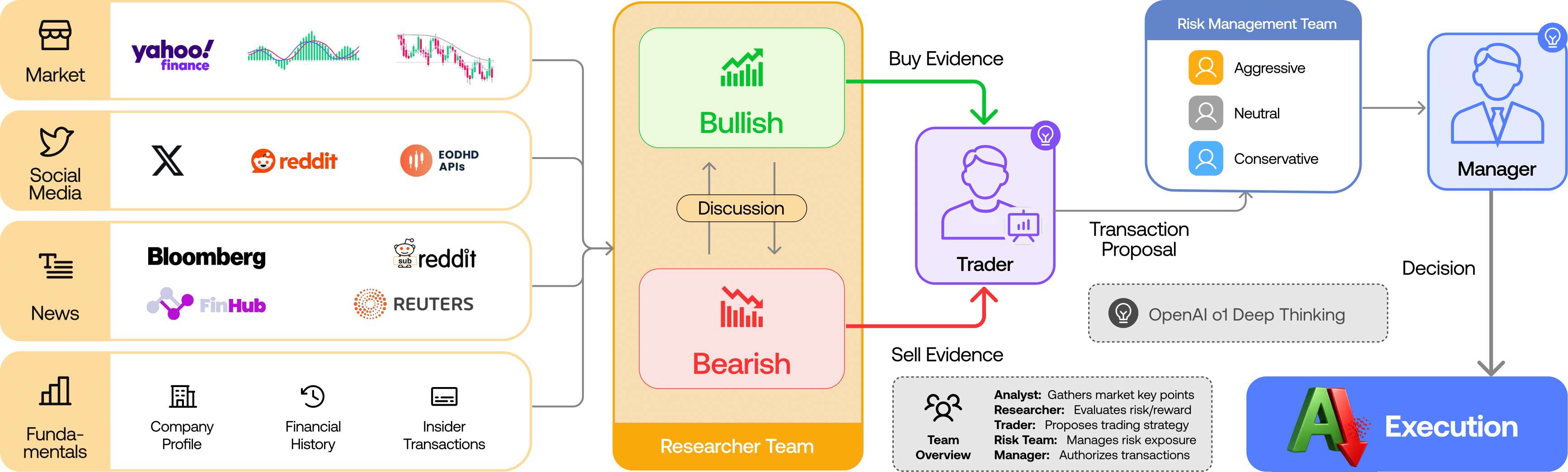

Algorithmic Trading Strategies

Four AI-powered algorithmic strategies leveraging technical indicators (MACD, RSI, Bollinger Bands, ATR) for different market conditions. Each strategy is powered by our multi-agent system analyzing chart patterns, volume signals, and momentum indicators with precision timing.

Select Strategies to Backtest

Choose from TradingView expert algorithms - like having a personal hedge fund team